Medicare Part B is a government health insurance program that covers medically necessary services such as doctor visits, outpatient care, and preventive services. However, it is important to note that unlike Part A, which is free for most people, Part B requires a monthly premium.

The standard monthly premium for Part B in 2023 is $164.90, an decrease from the 2022 premium of $170.10. However, some beneficiaries may pay more or less than the standard premium depending on their income. The amount a person pays is determined by their modified adjusted gross income (MAGI), which is the total of their adjusted gross income plus any tax-exempt interest they receive.

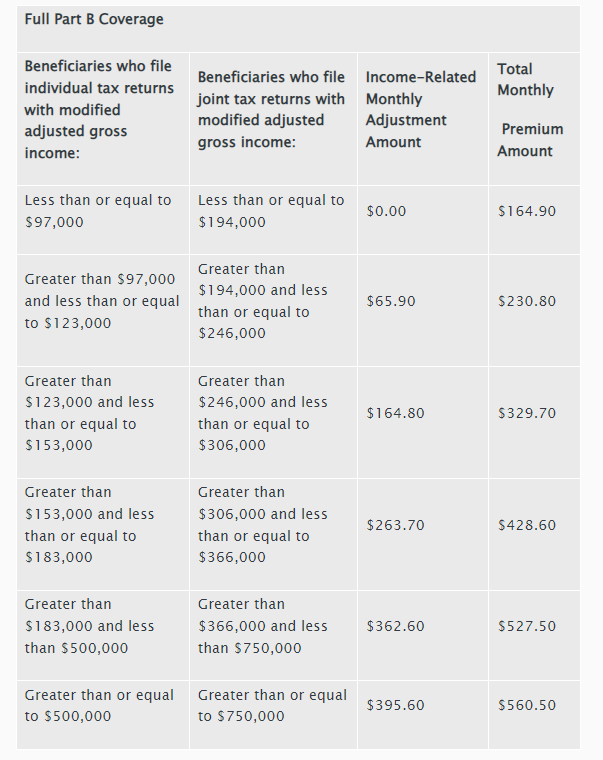

In general, individuals with a MAGI of $97,000 or less and couples with a MAGI of $194,000 or less pay the standard Part B premium. However, those with a higher MAGI may pay an Income-Related Monthly Adjustment Amount (IRMAA) in addition to the standard premium. The IRMAA is based on a sliding scale and ranges from $65.90 to $395.60 per month.

It’s important to note that the Part B premium can change each year, and the income thresholds used to determine IRMAA may also change. Additionally, some beneficiaries may be eligible for help paying for their Part B premiums through programs such as the Medicare Savings Program or Extra Help.

In summary, while Medicare Part B provides important coverage for a variety of healthcare services, it is not free and requires a monthly premium. Understanding the different factors that can impact your Part B premium, such as your income and eligibility for assistance programs, can help you plan for healthcare costs in retirement.