Turning 65?

Join Our...

MEDICARE 101 WEBINAR

Every Thursday at 2 PM PT

Ray Martin, President of Martin & Associates

Retire Right, Retire Smart!

We help people navigate retirement with clarity and confidence. Through education and thoughtful guidance, we simplify complex financial and retirement decisions, removing confusion, fear, and uncertainty. While many approaches add unnecessary complexity, our focus is on helping clients truly understand their options—so they can protect their health, preserve their wealth, and move into retirement with a clear plan to Retire Right, Retire Smart.

THE RETIRE SMART METHOD

Our three-step process to help you build a strong retirement plan, maximize your benefits, and protect your income—while keeping costs low and the process as simple and stress-free as possible.

STEP 1: EDUCATION

We start with education because understanding your options is crucial. We provide clear, straightforward guidance on the key components of a successful retirement plan, including income planning, Social Security timing, investment strategies, tax-efficient withdrawals, healthcare planning, and legacy considerations. You’ll learn how these pieces work together so you can protect your lifestyle, reduce financial stress, and retire with confidence.

STEP 2: FREE RETIREMENT STRATEGY SESSION

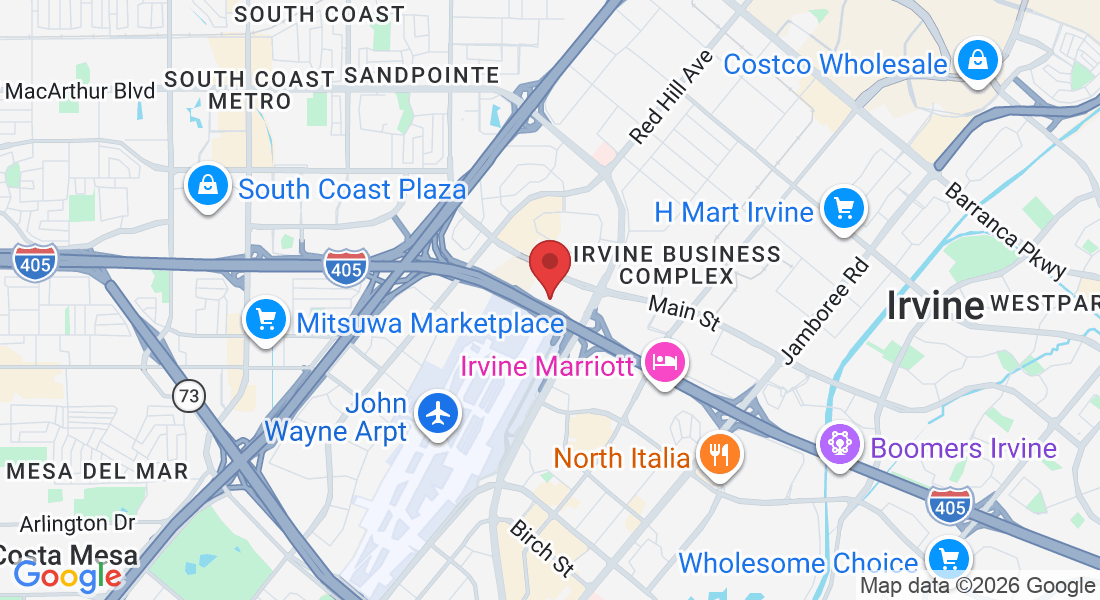

Next, we offer a personalized, no-obligation meeting by phone, online, or in-person where we discuss your specific retirement goals and financial situation. During this meeting, we’ll review where you are today, answer any questions you may have, and help you understand which strategies may best fit your needs based on your income goals, assets, timeline, and overall retirement priorities.

STEP 3: EXECUTE THE GAMEPLAN

Once we’ve agreed on the best strategy, we handle the details. We’ll help you implement the retirement plan we’ve selected together, ensure all paperwork is completed accurately, and guide you through each step of the process. Lastly, we’ll follow up to make sure your transition is smooth, your plan is working as intended, and you feel confident moving forward.

Ready to Simplify Your Retirement Planning?

Sign up for Ray's Retire Right Report Monthly E-Newsletter!

See What Our Clients Have to Say...

Martin & Associates Blog

Ray's Retire Right Report -Mar 2026

Ray's Retire Right Report - Mar 2026 ...more

Ray's Retire Right Report

February 17, 2026•1 min read

Ray's Retire Right Report -Feb 2026

Ray's Retire Right Report - Feb 2026 ...more

Ray's Retire Right Report

January 19, 2026•1 min read

Ray's Retire Right Report -Jan 2026

Ray's Retire Right Report - Jan 2026 ...more

Ray's Retire Right Report

December 22, 2025•1 min read

Ray's Retire Right Report - Dec 2025

Ray's Retire Right Report - Dec 2025 ...more

Ray's Retire Right Report

November 19, 2025•1 min read

Ray's Retire Right Report - Nov 2025

Ray's Retire Right Report - Nov 2025 ...more

Ray's Retire Right Report

October 27, 2025•1 min read

Ray's Retire Right Report - Oct 2025

Ray's Retire Right Report - Oct 2025 ...more

Ray's Retire Right Report

September 24, 2025•1 min read

Frequently Asked Questions

What do you charge for services?

There is never a cost or charge to you for our services. As we help our clients through the Medicare process and establish Medicare Supplement, Advantage and Part D plans, we are compensated by the insurance carriers directly.

What services do you offer as an insurance broker specializing in Medicare?

We help you compare Medicare Supplement, Medicare Advantage and Part D prescription drug coverage options to find you the most suitable insurance to meet your healthcare and financial needs.

How do you determine which Medicare plan is right for me?

We assess your healthcare needs, budget, preferred providers, and medication requirements to recommend suitable options.

How is an independent agent different from a representative of one insurance company?

As independent agents, we work with multiple insurance providers, giving you a variety of options to find the best plan for your needs and budget.

Will using your services increase my premium costs?

No, the premiums for plans are the same whether you enroll through us or directly with the insurance company.

I’m turning 65 soon—when should I contact you?

It’s best to contact us about three to six months before your 65th birthday to explore your options and ensure timely enrollment.

What happens if I’m still working and have employer coverage?

You may or may not be able to delay portions of Medicare depending on a number of variables regarding your employer group insurance plan. We'll help you determine which Parts of Medicare will be required at 65, if any, and which Parts can be delayed until you lose/leave your employer group insurance.

Can you help me switch Medicare plans?

Absolutely, we can review your current plan and guide you through switching during the appropriate enrollment period.

What states are you licensed in?

We are licensed in 30+ different states so we can help Medicare recipients all over the country.