Most people will pay $134/mo for their Part B premiums in 2017, however, people who earned higher incomes in the past could pay an Income Related Monthly Adjustment Amount (IRMAA) up to $428.60/mo. and an extra IRMAA for their Part D Prescription Plan also. If these people have experienced a life changing event (i.e. work […]

Medicare Matters – What’s in Your Wallet?

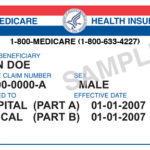

June’s Section Having finally reached the age of 65, a client recently received her Medicare card. She noticed the card say it should be carried when away from home. So naturally, she placed it in her wallet. And then she realized that, displayed on the front was her Social Security Number! That made sense. It’s […]

Medicare Matters – Usual, Customary and Reasonable Charge

Usual, Customary and Reasonable Charge (UCR) is the amount paid for a medical service based on what providers in a geographic area usually charge. Those are sometimes used to determine the “allowed amount” for payment of claims on health insurance plans from your employer, individual and family plans as well as Medicare, Medicare Advantage plans […]

Medicare Matters – Combating Waste Fraud and Abuse and Orphan Drugs

Combating Waste and Fraud in Medicare: President Trump’s choice for Secretary of the Department of Labor, is Alexander Acosta. There is consensus among both Democrats and Republicans that this is a good choice. He has been described as “just a mild-mannered law school faculty member.” Allison Bell, in an article for LifeHealthPro. In reality, from […]

Medicare Matters – Enrolling in Medicare

Compared to individual or group health insurance plans, Medicare is unique in that it has no out-of-pocket spending limits. That’s why most people purchase a solid Medigap [Medicare Supplement] policy that will fill in all the gaps in Medicare and give you 100% of first dollar coverage for medical expenses. The alternative is enrolling in […]

Medicare Matters – 2017 Part D Changes

Now that we are in the New Year there are some things you should remember about your Part D prescription drug plans. In the fall (September and October) of each year, the Part D insurance companies send out a letter called ANOC. This acronym means ‘Annual Notice of Changes’ with emphasis on ‘Changes’. The companies […]

Medicare Matters – Annual Disenrollment Period (ADP)

You have two basic choices in Medicare to take care of your hospitalization, doctor visits and laboratory tests – Medicare Advantage (also called Medicare Part C) and original Medicare (comprised of Medicare Parts A and B). Original Medicare is often coupled with a Medicare supplement plans A through N. The majority of Medicare Advantage plans […]

Medicare Matters – 2017 Part B Premiums

The C.O.L.A. (Cost of Living Adjustment) was announced by the Social Security Administration. It will be .3% for 2017. That’s pretty small and not much better than 0% which was the C.O.L.A. for 2016. To put this in perspective, if a retiree were receiving $1000 per month in Social Security benefits, a 0.3 % increase […]

On A Personal Note – Ray Speaks at the LAAHU Annual Senior Health Care Summit, Dodger’s Big Win and My Son Hits 26!

As you know, education is a crucial part of my work and I was very honored to be a guest speaker to over 200 agents who attended the annual Los Angeles Association of Health Underwriters. I shared the duties with my friend and colleague Harry Thal. The audience just loved the marketing tips, jokes and […]

Medicare Matters – Annual Open Enrollment Officially Starts

The 2016 Medicare Open Enrollment started October 15th and continues till December 7th. During this time Medicare eligible people are able to enroll in, or change their current Medicare Advantage (MAPD) HMO/PPO, or stand-alone Part D/drug plan. Remember, if your current plan or employer/ retiree coverage is renewing in 2017 and you are satisfied with […]