The C.O.L.A. (Cost of Living Adjustment) was announced by the Social Security Administration. It will be .3% for 2017. That’s pretty small and not much better than 0% which was the C.O.L.A. for 2016. To put this in perspective, if a retiree were receiving $1000 per month in Social Security benefits, a 0.3 % increase would be $3. For a person receiving $1,500 per month, a .3% increase would be only $4.50. You can do the math to figure out what you own increase might be.

So how does this apply to those on Medicare? If your Part B premiums are withheld from your retirement checks, there is something known as a ‘Hold Harmless’ provision on Part B. If there is little or no C.O.L.A. increase, you are protected from having your retirement benefit decrease. At least 70% of retirees have their Part B premiums automatically deducted from their Social Security checks each month. The other 30% of recipients are composed of those new to Medicare in 2016. Those who went on Medicare in 2016 paid a premium of $121.80 (or more for high income earners.) There was a rumor that the Part B premium in 2017 would be raised to $149 but due to the Hold Harmless provision, premiums will remain at $121.80.

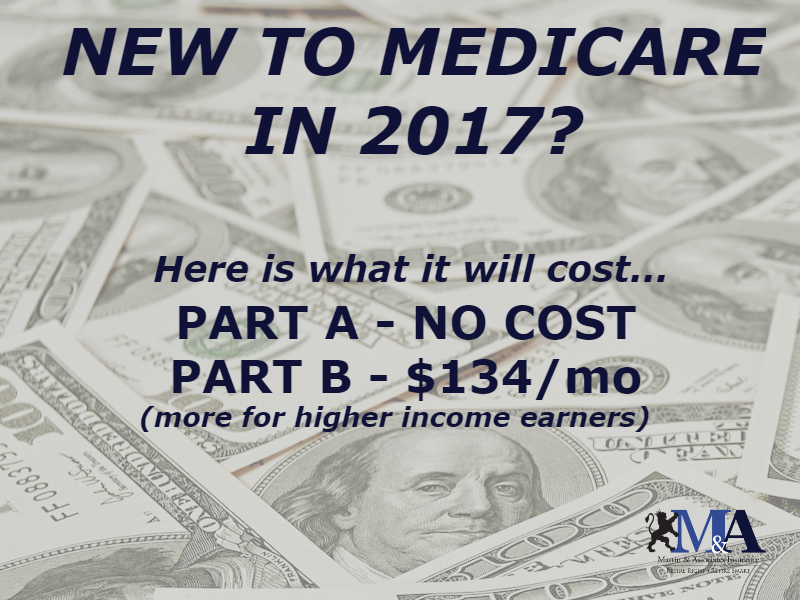

All others —particularly those new to Medicare in 2017— will see a significant jump in rates compared to what most will pay. For those who joined Medicare before 2016, they are still paying the lower premium of $104.90. The bottom line is, don’t worry that the small C.O.L.A. for 2017 will leave you with less Social Security income than you had in 2016. There does need to be a fix to but only an act of Congress can fix that. Don’t hold your breath, Congress usually kicks the can down the road.

Thanks for reading!