We get questions all the time about what the Medicare donut hole is.

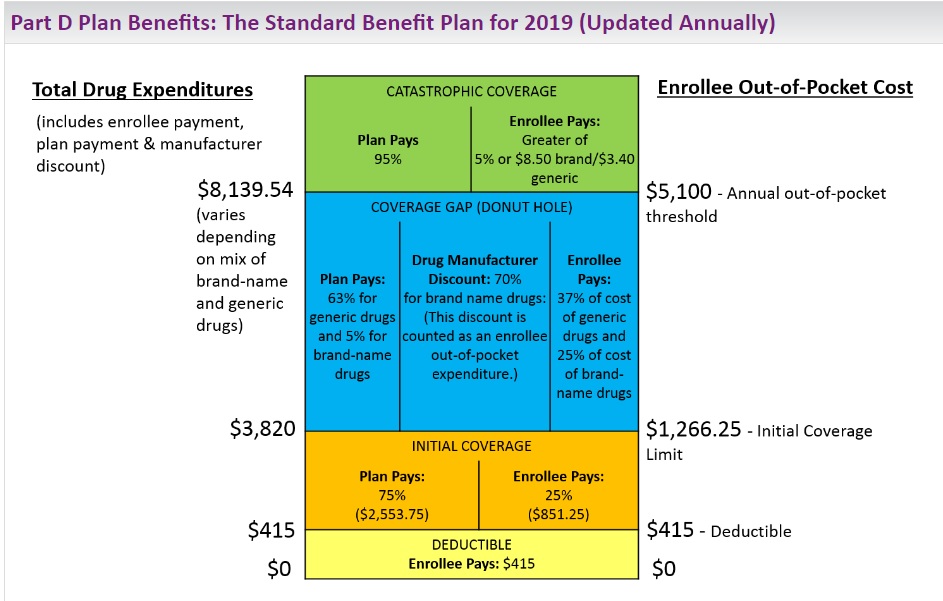

The donut hole is a gap in the prescription coverage under Part D of Medicare when the total costs of you prescriptions throughout a given year reaches $3820 (2019).

That is a combination of what you have paid out of your pocket and what your Part D provider has paid as well.

In order to understand the donut hole better, I think it would help to know about the four stages to these Part D prescription plans.

- Deductible Stage – Most plans have a $415 deductible but there is a range. Some other plans have a deductible of $365 and there are some plans that don’t have any deductible. But if you do have a deductible, once your deductible is met, you then go into what’s called the initial coverage stage.

- Initial Coverage Stage – In the initial coverage stage, usually you pay about 25% of the cost of your prescriptions brand name and generic. Then if the total cost of your prescriptions reach that $3820 then you go into the donut hole.

- Donut Hole (Coverage Gap Stage) – The donut hole is the third stage to the prescription plans…this is also known as the coverage gap. When you hit the donut hole, your cost for brand name prescriptions will stay at about 25% but the percent you will have to pay for generics will go up from 25% to 37%. You remain in the donut hole until your true max out-of-pocket reaches $5,100. That amount does include whatever the manufacturers have contributed to the cost of your brand names while you were in the donut hole. When you’ve hit this amount of $5,100, you then go into the fourth stage of prescription plans called the catastrophic stage.

- Catastrophic Stage – You will get a major discount on your prescriptions at this point. You’ll either pay 5% of the cost of your prescriptions or $8.50 for brand names and $3.40 for generic, which ever of those two are higher.

So what does this mean for you?

If you aren’t taking any prescriptions or even just a few low cost generics, you really don’t have to worry about the donut hole.

If you do take some expensive prescriptions, then what you may see is that for a number of months at the beginning of the year, your costs may be steady. But what you could see is that at a certain point in the year, the costs of your prescriptions goes up. That probably means you’ve hit the donut hole threshold of $3820.

Usually the Part D providers will mail you out information on where you are in these four stages throughout the year.

Side note: The donut hole will actually be going away by 2020 so you can just get rid of the third stage of these prescription drug plans that I just described and everything else should remain the same.

In conclusion…

If you are someone that usually hits the donut hole each year or if you are taking a number of prescriptions, you may be someone who should be reviewing your prescription drug plan on an annual basis.

From October 15th to December 7th every year, you can change your prescription plan selection for the following year.

If you need help in evaluating your prescription drug plan, give us a call at 800-464-4941.

Thanks for reading!