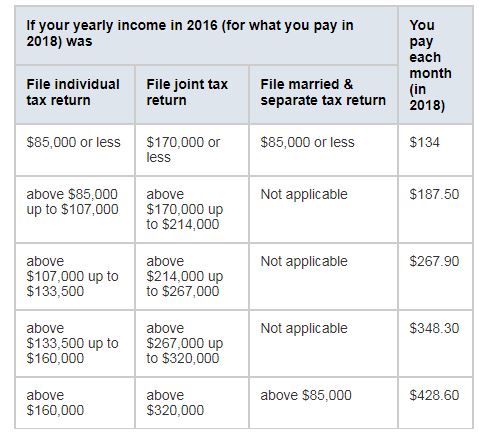

IRMAA stands for Income Related Monthly Adjustment Amount. This is an additional Part B and Part D payment that Medicare recipients must pay if they are higher income earners.

What determines if someone is a high income earner?

Centers for Medicare Services are going to look at your Adjusted Gross Income and they always look back two years.

If you were a joint tax filer and your AGI is above $170k then you are considered a high income earners.

If you file a single tax return and your AGI is above $85k then you are considered a high income earner.

Here are the corresponding IRMAA for Part B (2018) that you will pay based on your income:

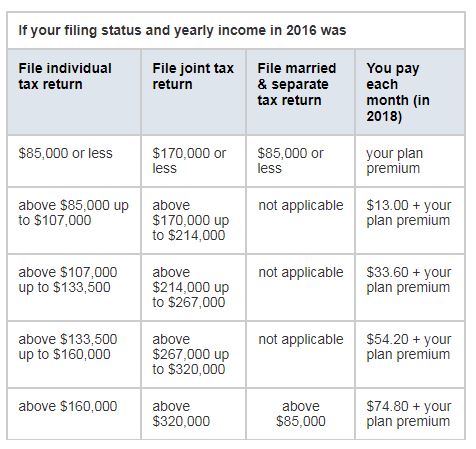

If you are in a higher income bracket, then Medicare is also going to be charging you additional premiums for your Part D prescription drug plan also. Here are the corresponding amounts for Part D IRMAA (2018):

Usually, people start to research what IRMAA is when they receive a letter from Social Security that they will be charged extra for their Medicare premiums. Not fun!

If someone has an IRMAA but has also had a recent life changing event, there are ways to get your IRMAA reduced!! You can see the video I made on this here: https://www.youtube.com/watch?v=YDgeagDtgxo

I hope this helps clear up some of the confusion on IRMAA.

If you would like more information on Medicare, request a copy of The Nuts & Bolts of Medicare book here and we will mail it out to you!

If You Would Like to Have Your Own Personal Independent Medicare Agent that specializes in California, request a consultation here!

Thanks for watching!