EXISTING CLIENTS - ANNUAL ENROLLMENT PERIOD REVIEWS

Dear Valued Client,

Thank you for your interest in reviewing your Medicare plans for 2026.

As you may know, the Medicare Annual Enrollment Period or more commonly known as “Open Enrollment” is upon us and runs October 15th – December 7th.

During this time, our Medicare clients can review and adjust certain plans for 2026.

Part D

If you are needing to review your stand-alone Part D Prescription Drug Plan, please visit our Part D Resource Page here to learn about the changes and options to review your plan for 2026: https://aep.martinmedicare.com/

Medicare Advantage (Part C)

If are enrolled into or interested in joining a Medicare Advantage (Part C) plan, please schedule a time to chat with our office. We do need to cross reference your doctors, prescriptions and any other needs before we help you make a selection. Schedule a Medicare Advantage consultation here!

Medicare Supplement/Medi-Gap (Plan F, G, N, etc.)

Medicare Supplement clients that reside in CA, OR, ID, IL and NV it’s best to review your policy near your birthday when we have a guarantee to move you plans with no medical underwriting, no pre-existing conditions. If your birthday is coming up, please schedule a Medicare Supplement plan review around your birthday here!

Brand new to Medicare? Schedule a phone call with one of our agents today by clicking here!

If you have any further questions, please call the office at 800.464.4941

Thank you!

Elliott Martin

Phone

Toll Free: 800-464-4941

Local: 949.854.4941

Fax: 949.266.9508

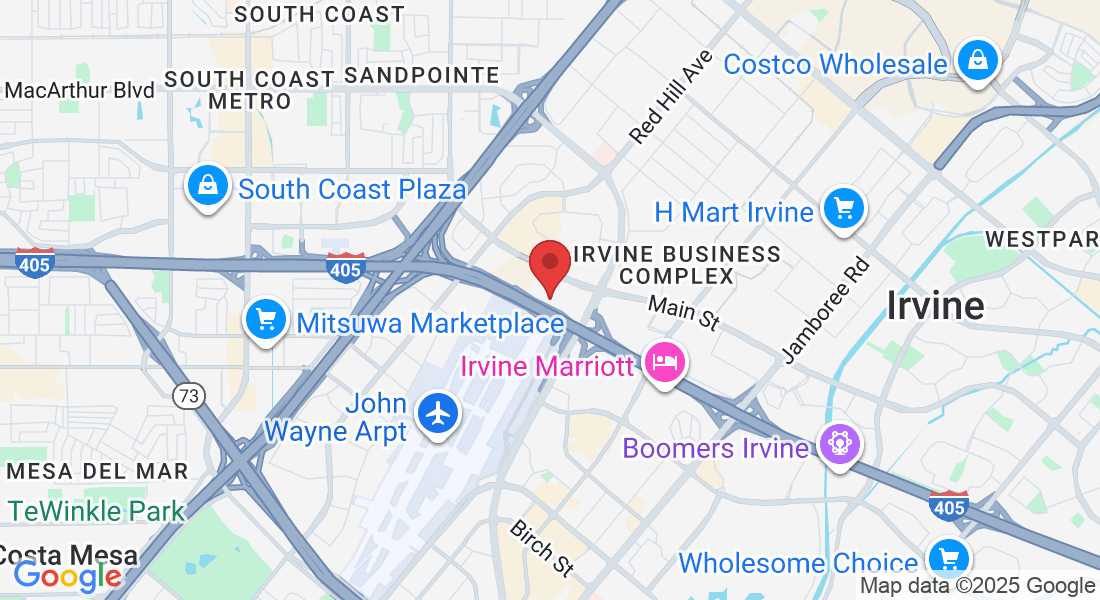

Address

30 Executive Park, Ste 250, Irvine CA 92614

New to Medicare? Schedule a FREE Medicare Strategy Session Today!

Frequently Asked Questions

What do you charge for services?

There is never a cost or charge to you for our services. As we help our clients through the Medicare process and establish Medicare Supplement, Advantage and Part D plans, we are compensated by the insurance carriers directly.

What services do you offer as an insurance broker specializing in Medicare?

We help you compare Medicare Supplement, Medicare Advantage and Part D prescription drug coverage options to find you the most suitable insurance to meet your healthcare and financial needs.

How do you determine which Medicare plan is right for me?

We assess your healthcare needs, budget, preferred providers, and medication requirements to recommend suitable options.

How is an independent agent different from a representative of one insurance company?

As independent agents, we work with multiple insurance providers, giving you a variety of options to find the best plan for your needs and budget.

Will using your services increase my premium costs?

No, the premiums for plans are the same whether you enroll through us or directly with the insurance company.

I’m turning 65 soon—when should I contact you?

It’s best to contact us about three to six months before your 65th birthday to explore your options and ensure timely enrollment.

What happens if I’m still working and have employer coverage?

You may or may not be able to delay portions of Medicare depending on a number of variables regarding your employer group insurance plan. We'll help you determine which Parts of Medicare will be required at 65, if any, and which Parts can be delayed until you lose/leave your employer group insurance.

Can you help me switch Medicare plans?

Absolutely, we can review your current plan and guide you through switching during the appropriate enrollment period.

What states are you licensed in?

We are licensed in 30+ different states so we can help Medicare recipients all over the country.